GBP/USD at Crossroads: Geopolitical Uncertainty, Trump Tariffs, and U.S. Data in Focus

- Geopolitical tensions and U.S. economic data set the stage for heightened volatility.

- Rising wedge pattern signals potential downside risks.

- Ukraine peace talks and shifting trade policies are key market drivers.

- Friday’s U.S. payrolls report could be a major catalyst for further swings.

Market Overview

GBP/USD faces a turbulent week as geopolitical developments and critical U.S. economic data converge. The currency pair is increasingly behaving as a barometer for the likelihood of a Ukraine-Russia peace agreement and the potential fallout from escalating U.S.-EU trade tensions. This suggests that market sentiment could be dictated more by breaking headlines than by scheduled economic events.

Technically, downside risks are mounting as a rising wedge pattern warns of possible weakness. However, bullish momentum remains intact—for now—keeping traders on edge ahead of Friday’s pivotal U.S. jobs report.

GBP/USD Shifts to a Geopolitical Barometer

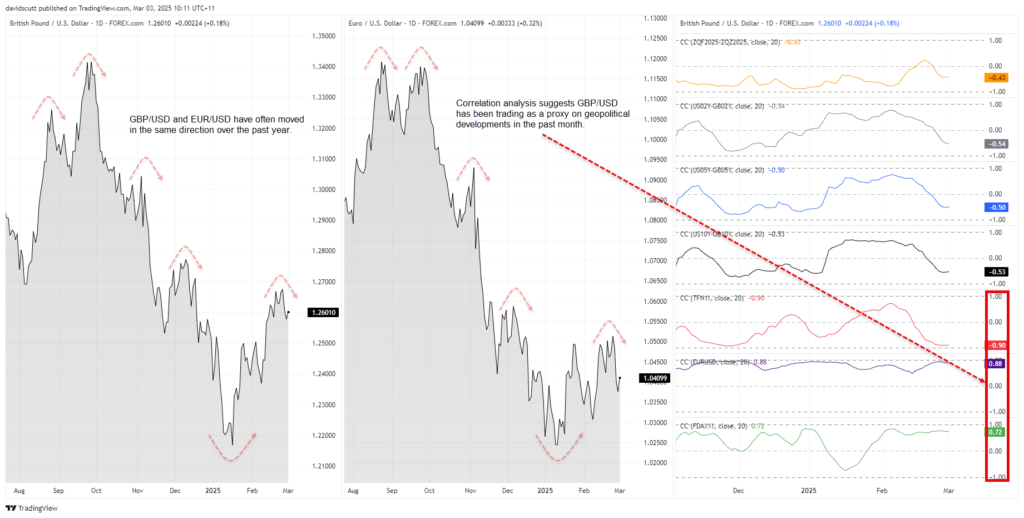

GBP/USD has veered away from traditional drivers like interest rate differentials, instead moving in step with geopolitical developments. The chart below tracks its rolling 20-day correlation with key variables spanning rates, FX, energy, and stock index futures.

While the pair has shown a weak inverse correlation with 2025 Fed rate cut expectations (yellow) and U.S.-U.K. interest rate spreads (grey, blue, black), shifts in rate outlooks have played only a minor role. The dominant forces? U.S. trade policy and Ukraine-related headlines.

Source: TradingView

Over the past month, GBP/USD has posted a -0.9 correlation with European natural gas futures—positive geopolitical news has generally driven gas prices lower, boosting cable. Despite the U.K.’s status as a major energy exporter, this connection makes sense, as cheaper energy supports economic growth by easing inflation and reducing rate pressures.

Additionally, strong correlations with EUR/USD and German DAX futures underscore how broader risk sentiment and European market trends are shaping GBP/USD’s trajectory. As geopolitical uncertainty persists, traders may find headline-driven volatility outweighing traditional macroeconomic signals.

Headline Risk May Trump Data

Source: TradingView

This implies that GBP/USD will stay highly reactive to headlines surrounding Ukraine peace negotiations. Likewise, U.S. tariff developments will be a key driver, with a 25% levy on Canadian and Mexican imports and an additional 10% tariff on Chinese goods set to take effect on March 4. Markets have only partially priced in these risks, meaning the final decision could have a significant impact on GBP/USD—particularly with European tariff measures expected in early April. If history is any indication, the U.S. dollar could strengthen if these tariffs are implemented, adding another layer of volatility to the currency pair.

Geopolitical Uncertainty Overshadows Traditional Market Movers

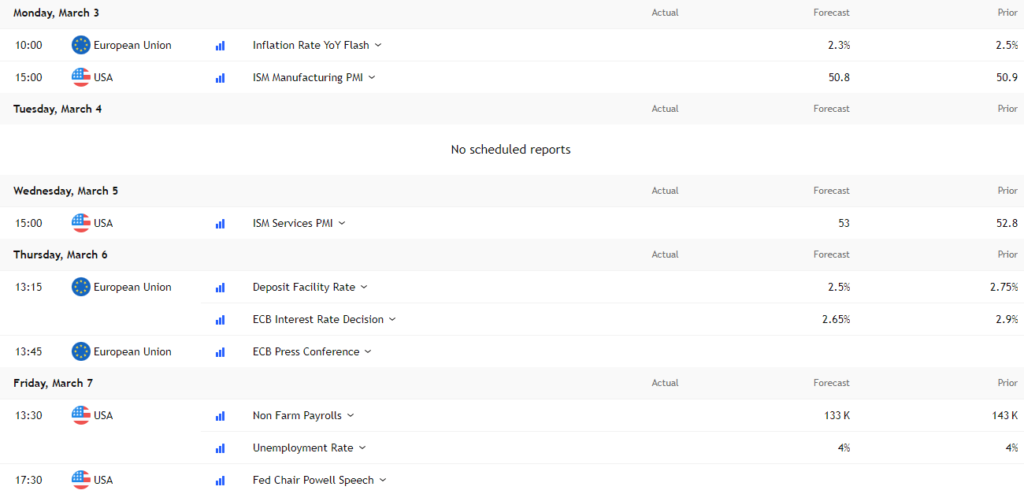

With geopolitical tensions dominating market sentiment, even typically high-impact economic events may take a back seat—unless there’s a breakthrough on trade policy or Ukraine.

Friday’s U.S. payrolls report remains the marquee event, particularly amid growing concerns over consumer resilience. However, despite the headline focus on job creation, it’s the unemployment rate that carries the most weight, as that’s the Fed’s primary benchmark. If payroll growth and unemployment data send conflicting signals, markets are likely to align with the latter.

Before then, ISM manufacturing and services PMIs warrant attention—both are proven market movers. A surprisingly weak reading could fuel risk aversion and intensify fears of a sharp U.S. growth slowdown.

For GBP/USD, the U.K. calendar is relatively light, but traders should keep an eye on Monday’s Eurozone inflation report and Thursday’s ECB decision, given cable’s strong correlation with EUR/USD. With a 25bp ECB rate cut fully priced in, the focus will shift to updated economic projections and any signals about the future policy path.

GBP/USD: Downside Risks Build Amid Bearish Momentum

Source: TradingView

GBP/USD remains trapped within a rising wedge—a pattern that often signals an eventual return to the broader bearish trend. With RSI (14) breaking its uptrend and MACD nearing a bearish crossover, downside momentum is gaining traction. However, unless these signals trigger a decisive wedge breakdown, the potential for two-way price action remains.

Key levels to watch:

- Upside: 1.2600 has acted as a pivotal level, flipping between support and resistance in recent months. Above that, 1.2720 is critical, aligning with the wedge uptrend and horizontal resistance. A breakout here could shift focus to the 200-day moving average and 1.2803 as the next upside target.

- Downside: 1.2550 is a crucial support zone, where the lower wedge trendline intersects with minor horizontal support. A breakdown below this level may accelerate losses, with the 50-day moving average and 1.2335 emerging as key downside targets.

With technical signals tilting bearish, GBP/USD faces a pivotal test in the coming sessions. Whether bulls can defend support or bears take control will likely depend on broader geopolitical and macroeconomic developments.